|

| Directv is first up in the iFreebies Challenge |

I forever wanted Directv and the NFL Sunday package. I am a huge fan of the NFL and Fantasy Football. As long as I can remember I wanted the NFL ticket package. When it first launched my Dad had the package for the first year or two. Then I moved out on my own and honestly couldn't afford such a luxury. Heck even heat was too expensive in those days. As I aged and my career progressed price was no longer an obstacle. We moved into our first house and I called Directv. Out they came, measured all kinds of angles in the sky and gave me crushing news. We didn't have a direct line of sight to the satellite in the sky. The neighbors trees were obstructing the view. Unless he cut down the trees, no Directv. I was relegated to cable, which did not have the NFL package, and I hated it every year come football season. That was 7 long years of hating cable.

We moved into our next house we would live in for about nine years and I was instantly excited. I couldn't see how any trees could block the view this time. I called Directv and out they came. They set up the dish and then realized it was a partially obstructed view because of the neighbors trees. The signal failed and again I was out of luck. Short of sneaking out into the night and taking my trusty chainsaw to the 150 year old hickory grove next door I wasn't getting Sunday Ticket. Relegated to hating cable for almost another decade.

Then it happened. We moved again and this time I scouted the house. All trees far enough back... we could buy this house (Mrs. iFreebies thought I was nuts). We moved in and day one out came the Directv guy and set me up. The America's Everything package and NFL Sunday Ticket. Life was glorious and all for about $100 a month.

Five years later I have to tell you I love Directv. Yes, the signal goes out when it pours outside but overall I love everything it offers. Sunday's are great and I feel like it is the Cadillac of TV. The only problem is we are really busy now. We don't watch as much TV and truth be told should watch less. I still paid year after year as the prices crept up and we renewed Sunday Ticket every year.

Well after The Mighty Thor laid waste to our finances last month I am starting to challenge everything. Are we truly getting our money's worth of enjoyment out of everything? The answer is no. First up... Directv. Let's take a look at the current state:

Premier Package $144.99

Multiple TV charge $21.00

Receiver Service $23.00

Sports Fee $1.97

Sunday Ticket (1 of 6) $59.99

Protection Plan $7.99

Sales Tax $12.95

Total $271.89

Now you can probably see two huge issues. First is holy cow, $271 a month! Take about rate creep. Seems like only yesterday is was roughly $100. Second is that Sunday Ticket is now $360 a year! That's a lot when I really started to consider that less games are shown on Sunday now that Thursday has a game a week. Week 1 is always free for everyone. My schedule has me out at other events probably six weeks this fall. That leaves about ten weeks for me to sit on the couch, do nothing and watch football all day. That's almost $40 a Sunday not including some of those weeks I would watch my home team instead. That's just too much.

|

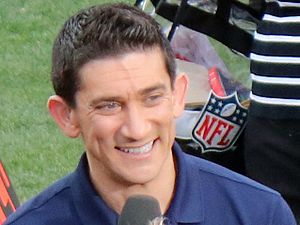

| Could Andrew Siciliano be my answer? |

I Googled possible solutions. Could I get the Red Zone channel stand alone? (For those that have never tried Red Zone it is simply addicting.) That would serve my needs. Andrew Siciliano could keep me updated on all of the games action. Dish has it stand alone, so do some others. Nope, not Directv. Sorry Andrew, it's been a magical five years. I also saw AT&T was offering some of their best customers free NFL Ticket for the year. Surely I must be one of those given what I spend between the two companies every month. I asked. Nope. Sorry NFL Sunday Ticket you have been fired.

Next I tried to down-size from the Premier package to the Xtra package and that started a whole thing. By the time I was done, they kept me on Premier at essentially Xtra prices by giving me six months of credits. It will be a pain to call back in six months but I took the deal. Remind me in six months to call again please. Then there was a host of smaller haggling issues and in the end I ended up getting the monthly bill down to $166.89. I know, I know, not exactly $30 a month but we are taking baby steps here. I can always go lower, no contract. It does save us $105 a month or $1,260 a year. Nothing to sneeze at for about 30 minutes of work.

It feels good but I have to say it hurts a little. I will be secretly watching my email for a free offer from AT&T or Directv but unless that happens my Sunday's will need to actually be productive (don't tell Mrs. iFreebies).